How to craft a product strategy

Implementing Chandra’s Step-by-step guide

Chandra Janakiraman's Strategy Blocks: An operator’s guide to product strategy, was recently published in Lenny's newsletter. Please check that out first, as we show you how to use Four/Four to automate this framework.

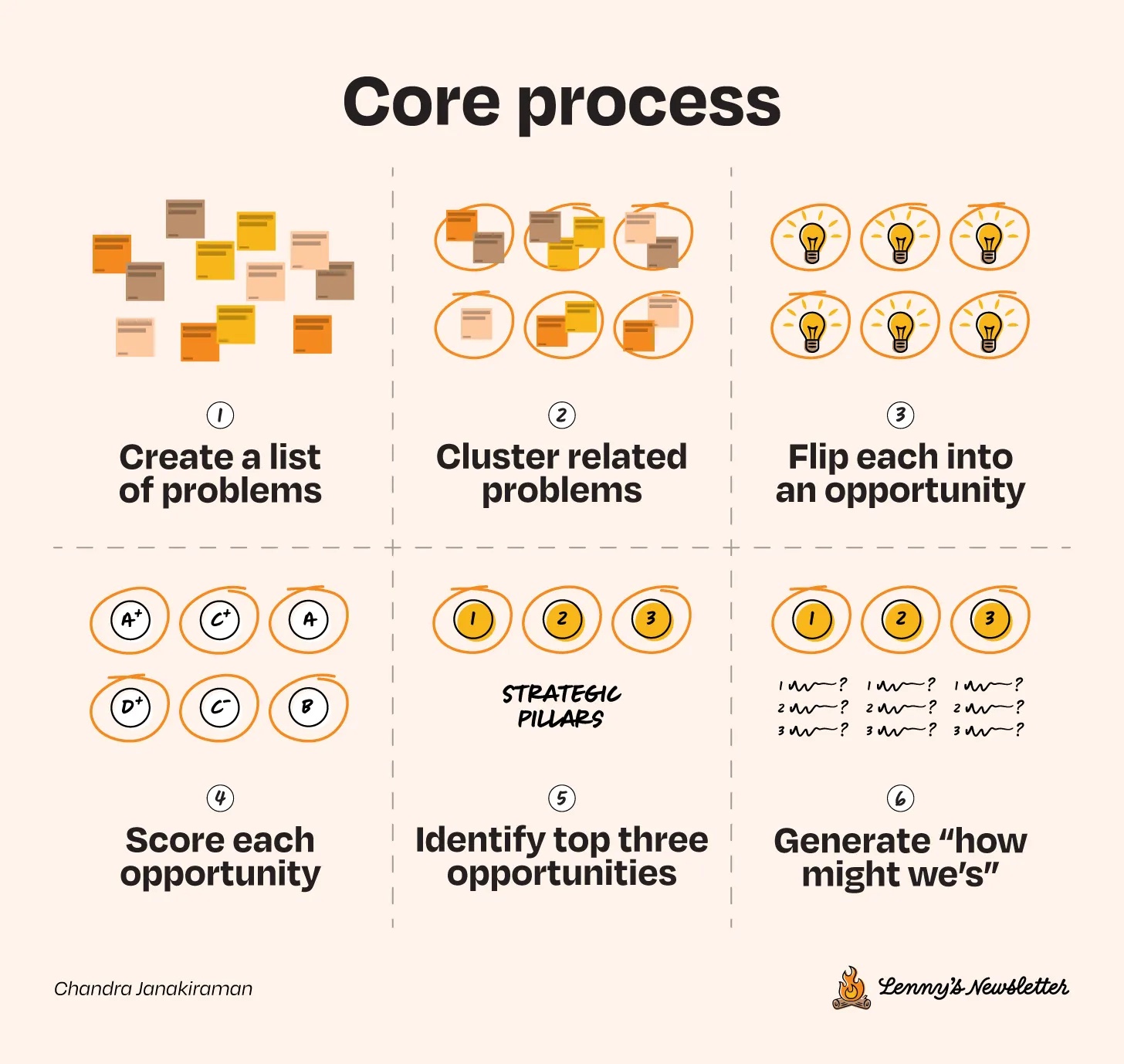

Step-by-Step guide

As part of Chandra’s ‘Strategy Blocks’, this core process is where the strategic pillars are selected.

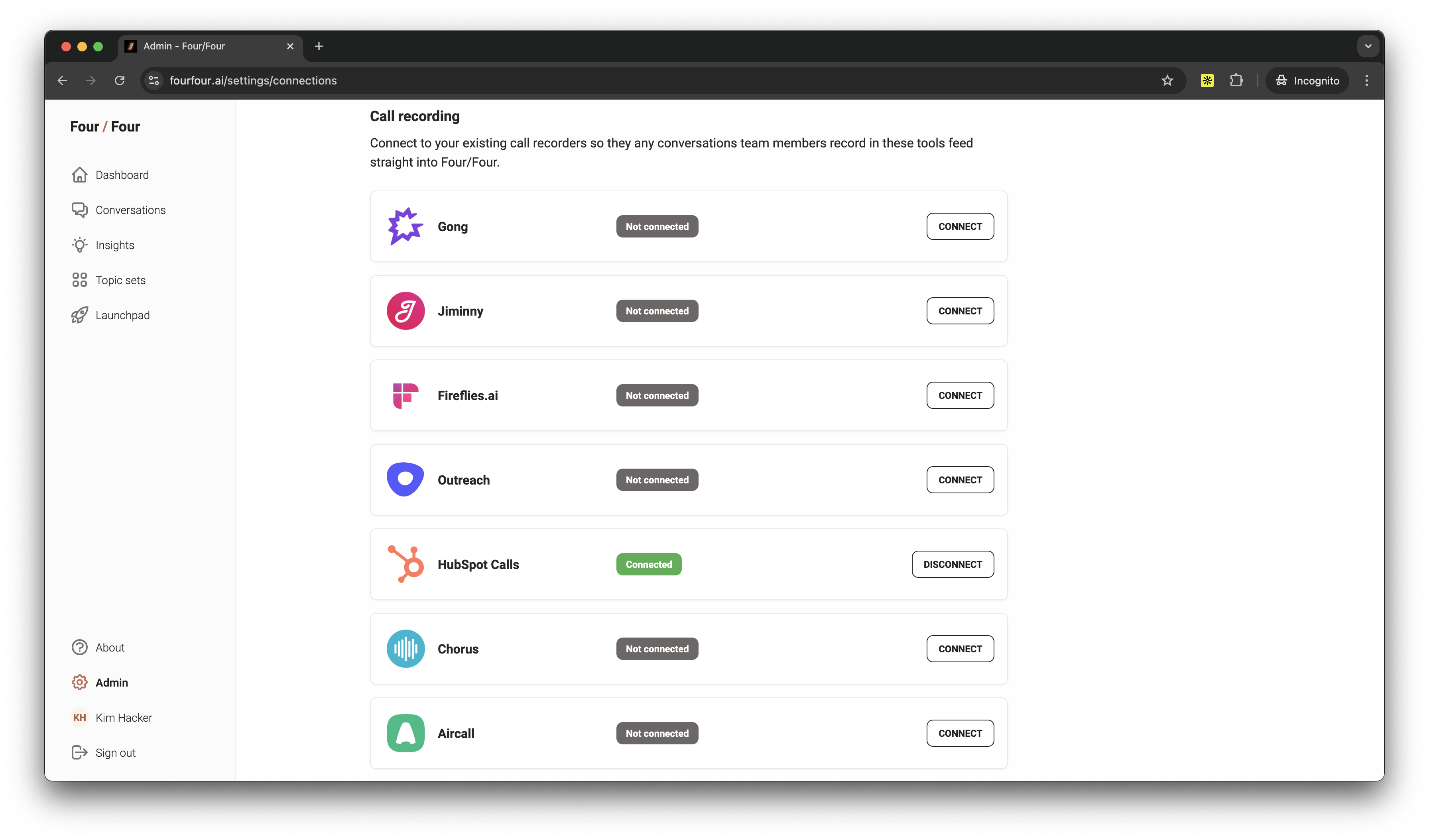

Step 0 – Source (we added this one)

Crap in, crap out.

This is the most important step. Anecdotal feedback plagued with recency bias and purchased analyst reports often forms the basis of the inputs used for this process. There’s just not enough depth.

Taking raw conversational input where a customer is expressing their needs firsthand, with context, is the most valuable and thorough means of needs capture.

At Four/Four we’re able to hook into multiple notetakers and VOIP calling solutions simultaneously, so all bases are covered.

Step 1 - Generate a list of problems.

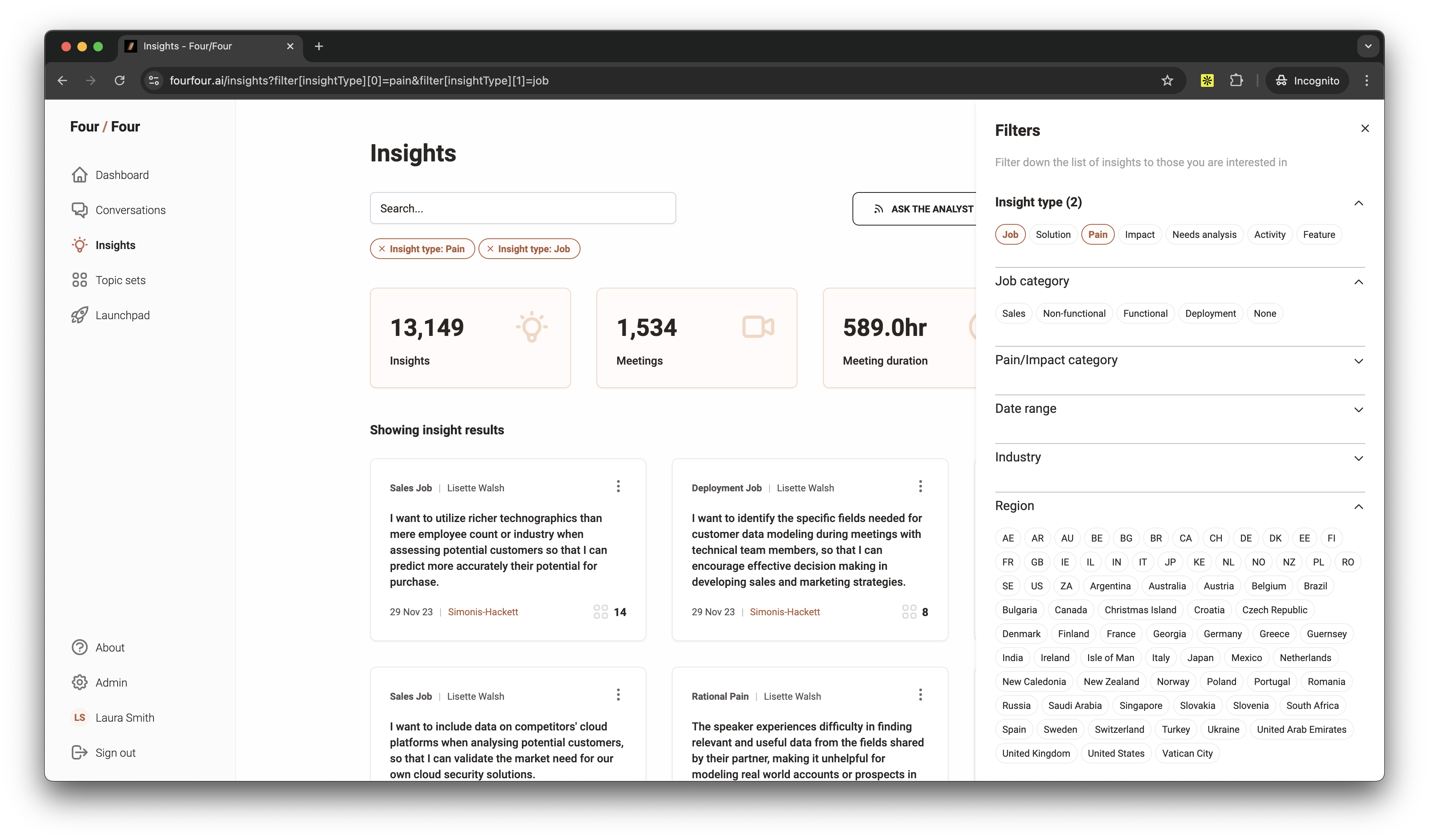

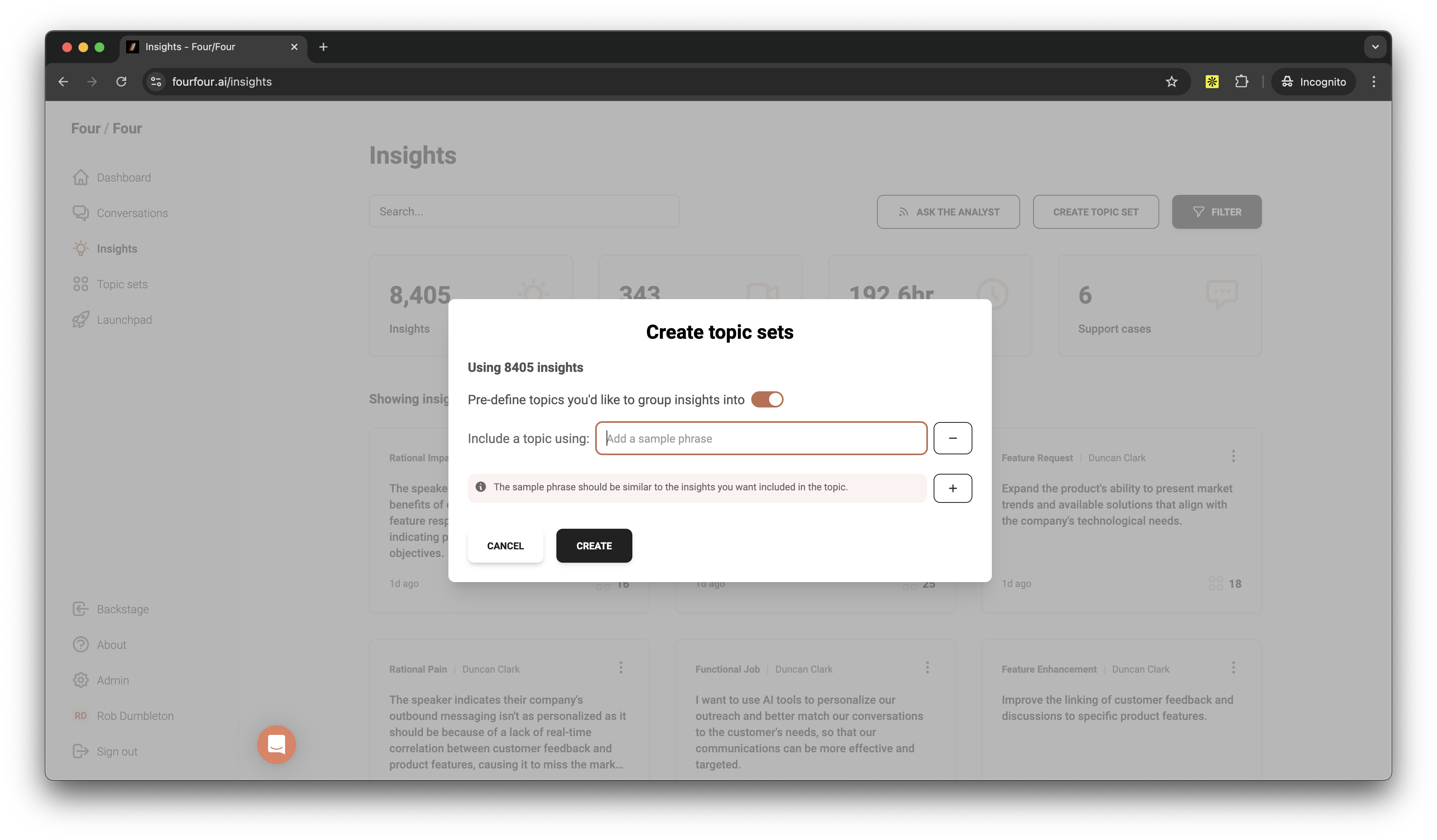

Focus on generating a high volume of problem statements to a shared repository.

Now the key here is breadth, depth and being able to maintain firmographic metadata to those problem statements. Otherwise, there’s no way of segmenting or sizing the problem later.

The methodologies used for extracting insights must be consistent across the business. We use principles from methodologies like JTBD, MEDDICC, SPIN, etc.

The methodologies used for extracting insights must be consistent across the business. We use principles from methodologies like JTBD, MEDDICC, SPIN, etc.

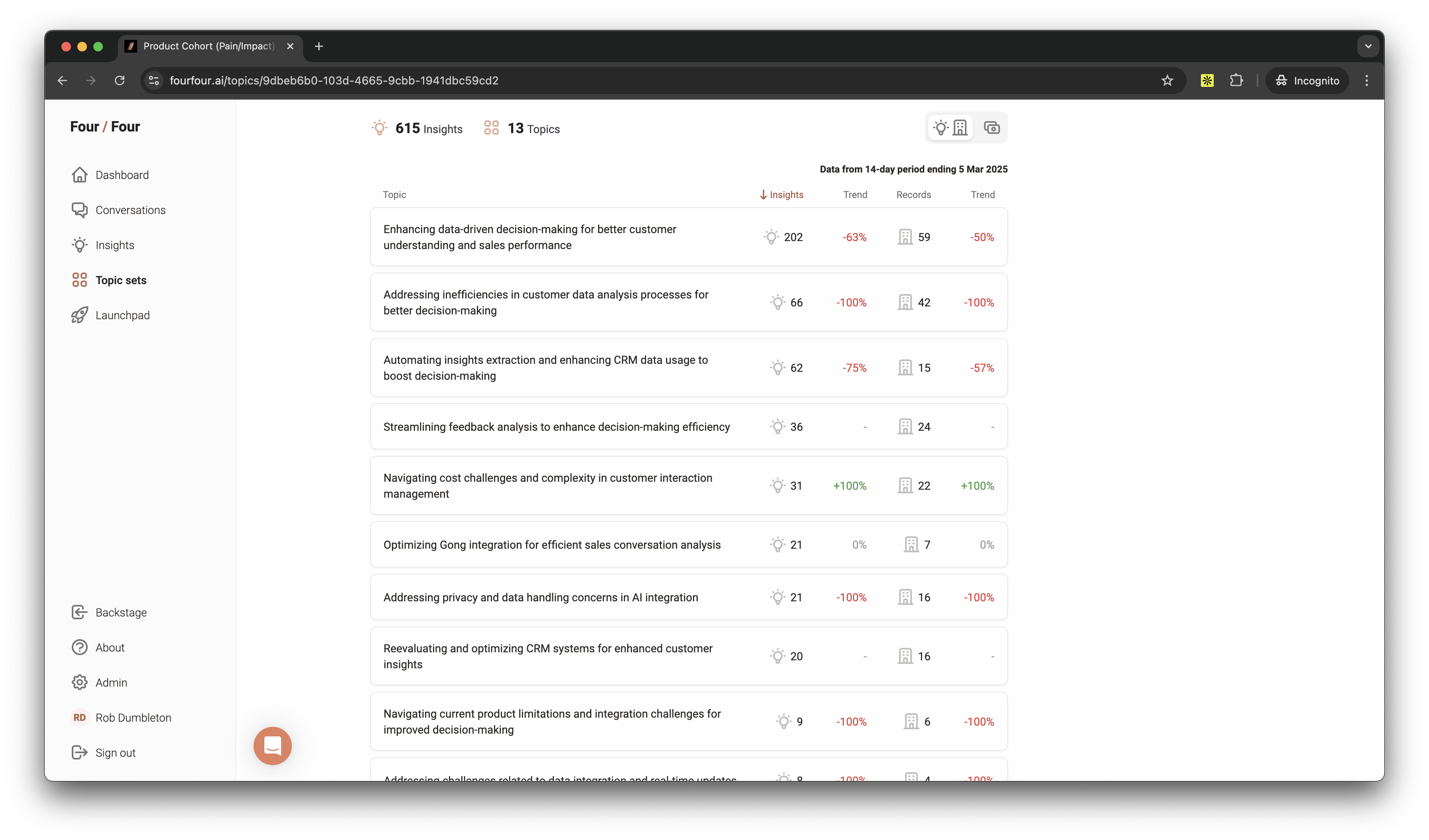

Step 2 - Cluster related problems into broader themes.

This is essentially pattern analysis, where we can run topic models to identify the trends and provide evidence around hypothesis.

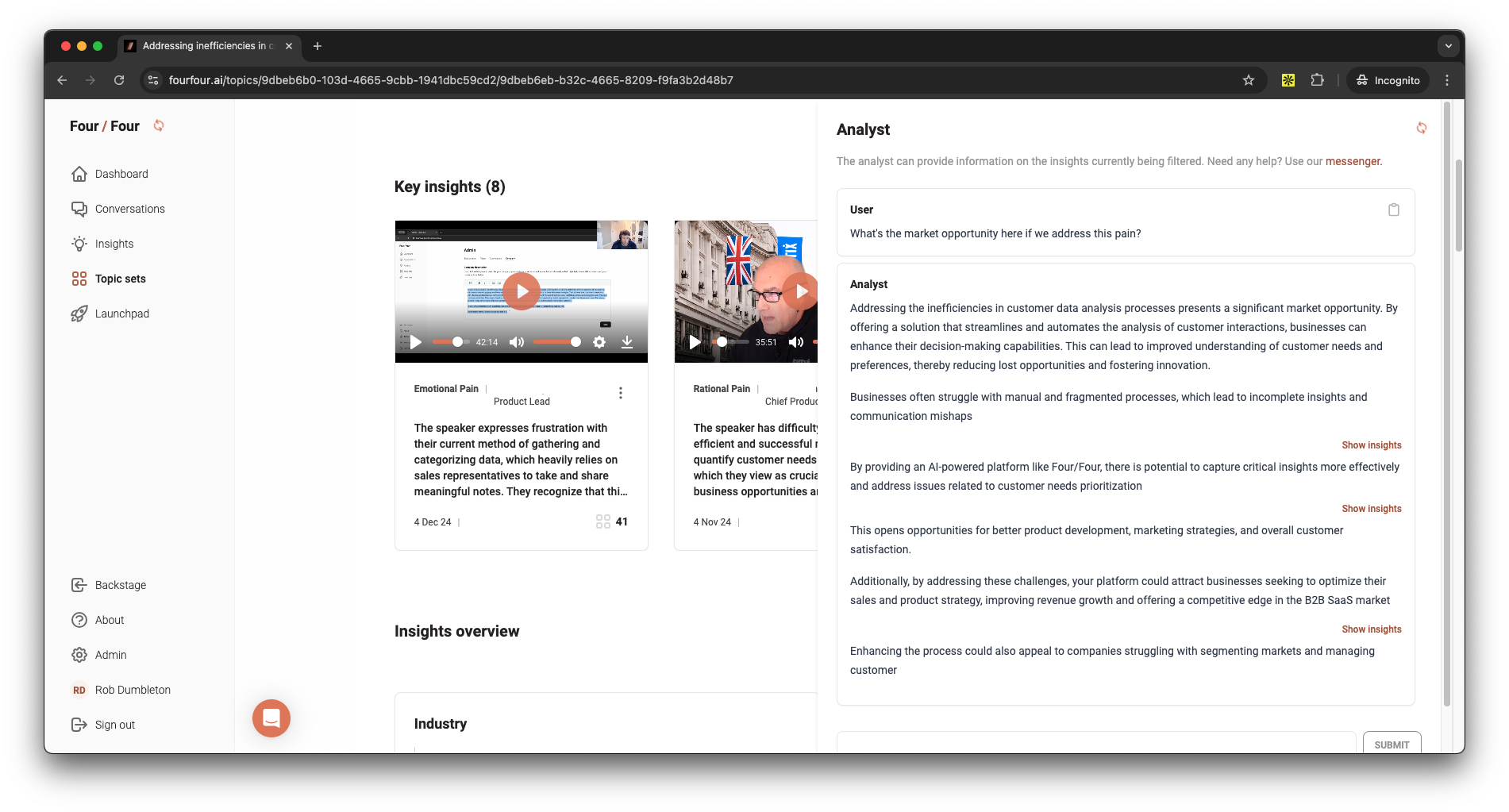

Step 3 - Flip each problem cluster into an opportunity.

Using the Analyst feature, you can then interrogate the specific problem and context to determine what the opportunity could be, to identify the or create a topic model based on the impact people are looking to make.

Step 4 & 5 - Score each opportunity, problem etc. to identify the priority

We do this very specifically by value and by volume, allowing our users to also add other metadata like company profile. For example, perhaps your focus is just on US Enterprise customers.

This is often where a scoring mechanism is completely speculative, using internal personnel to give it their gut feel and create a groupthink process. It needs to be based on concrete evidence to remove conjecture and address the facts.

Step 6 - For each strategic pillar, generate about three “how might we’s” as a way to spark ideation.

This is a preparatory step for the next step, the design sprint. Again this can be done by asking the analyst, which will use very focused context about your product and company, addressing the specifics around ‘how might we’ rather than ‘how might one’.

To run this process properly it takes a lot of preparation. With the right technology teams can:

- Save countless hours on manual analysis – aggregating, tagging and analysing

- Uncover hidden customer insights – users and channels that you haven’t had access to before at scale.

- Make evidence-based decisions – using the associated metadata and theming to discover trends

- Keeping it alive in real-time. Unlocking continuous product / market fit